Zero Capital Investment

Free Maintenance

Better Customer Experience

Instant Savings

Safer Work Spaces

Future Energy Solutions is on a mission to make it easy for businesses to make smart energy choices.

From commercial LED shop lights to beautiful architectural lighting solutions, by lighting corporate, commercial, and industrial businesses in their thousands with our energy-efficient lighting solutions, we have:

Generated

in energy savings

Installed

energy efficient lights

Eliminated

of CO2 emissions annually

Our lighting as a service solution makes designing, delivering, installing, and maintaining your LED commercial lights easier and more cost-effective than ever. Our LED conversion management team works closely with our customers to engineer custom lighting solutions perfectly tailored to their needs that deliver unrivaled savings.

We're proud to have provided our commercial lighting upgrade service some of the top private and publicly-owned brands nationwide with our commercial LED lighting, and industrial lighting solutions.

The All American Ford Dealership in Old Bridge, has been hailed as a repeat Ford President's Award winner for reaching the top 100 in Ford Credit Financing. Thanks to FES' Lighting-as-a-Service model, All American Ford is able to save over $35,000 on their annual energy costs.

FES' team of engineers worked closely with Lowellville High School in Lowellville, OH, to supply, deliver, and install energy-efficient lighting without any upfront costs.

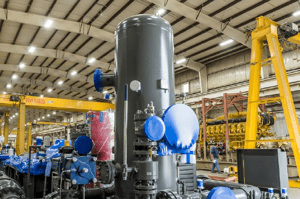

Dearing Compressor & Pump Co. provides industrial and energy customers with dependable equipment and systems for compressed air, gas, process gas and hydraulic applications.

Worldwide Business with Kathy Ireland®

FES founder and CEO Daniel Gold spoke with Kathy Ireland about how our commercial LED lighting company is paving the way for businesses to embrace LED without needing to utilize their budgets.

"I wanted to say a quick thank you for the lighting at Kingston. It was never great (before the FES Upgrade) and over the past two winters, it was a business killer and a safety concern. With the addition of the new lights (By FES) the site looks inviting and I believe it will make a big difference in car counts in the winter evenings"

"Future Energy Solutions is a wonderful company. The lighting upgrade program is everything they said and much more. The ability to upgrade the lighting and not have to spend a dime was such a huge win for my school. I never have to worry about buying bulbs again. The lighting has had a positive impact on students as well. The rooms and campus are so bright now! I am still seeing monthly savings on my energy bill. I would highly recommend this program to any school or business."

"It’s better lighting at a cost savings. They’re very easy to work with and very knowledgeable."

.png?width=200&name=FES-Ebook-1%20(1).png)

.png)